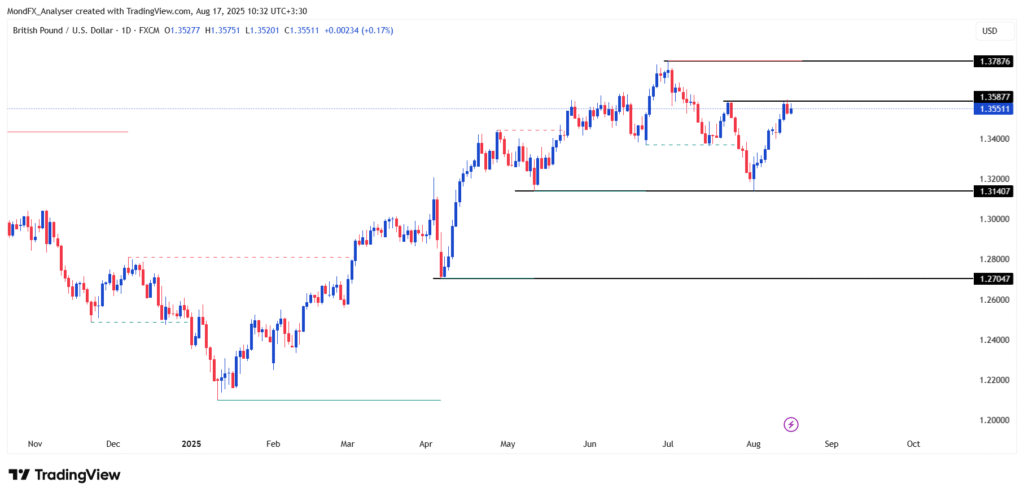

Pound Analysis (Daily Time Frame)

Main Scenario (with higher probability):

- The price is near the 1.3587 resistance zone and is attempting to break this resistance.

- If this level is broken, the bullish movement can extend towards the 1.3787 resistance area.

- The candlestick structure and trading volume indicate buyers’ strength in this zone.

Alternative Scenario (with lower probability):

- If the price fails to stabilize above 1.3587 and faces selling pressure, a correction towards the 1.3140 levels is possible.

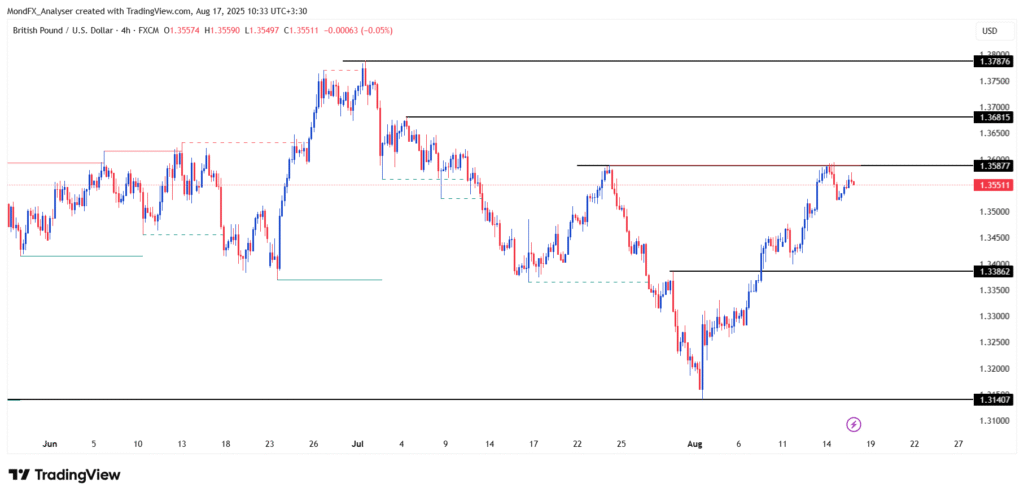

Pound Analysis (4-Hour Time Frame)

Main Scenario (with higher probability):

- After reaching and surpassing the 1.3587 resistance zone, the price is attempting to break through this level.

- If this level is broken and the 1.3587 resistance is cleared, the next targets will include the 1.3681 area and then 1.3787.

- The buyers’ strength and the bullish candlestick pattern on the current timeframe confirm the continuation of the uptrend.

Alternative Scenario (with lower probability):

- If the 1.3587 resistance is not broken and bearish candles form, a price correction towards the previously broken resistance at 1.3386 becomes possible.

- A break below this level could drive the price down to the 1.3140 support zone and establish a medium term corrective structure.

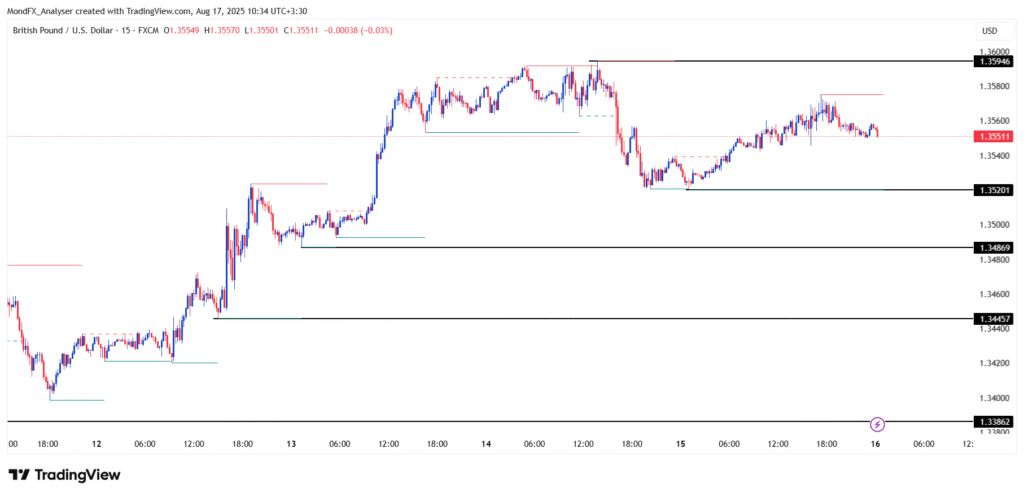

Pound Analysis (15-Minute Time Frame)

Main Scenario (with higher probability):

- After breaking the 1.3523 resistance zone, the price is stabilizing above this key level.

- If the price manages to break the 1.3594 resistance, the next targets will include 1.3620 and then 1.3648.

- Stability above 1.3594, along with the formation of bullish candles and proper volume, confirms the short term bullish scenario.

Alternative Scenario (with lower probability):

- If the price fails to break the 1.3594 resistance and returns below 1.3520 with a bearish candle, a short term correction towards the 1.3486 to 1.3445 support zone is possible.