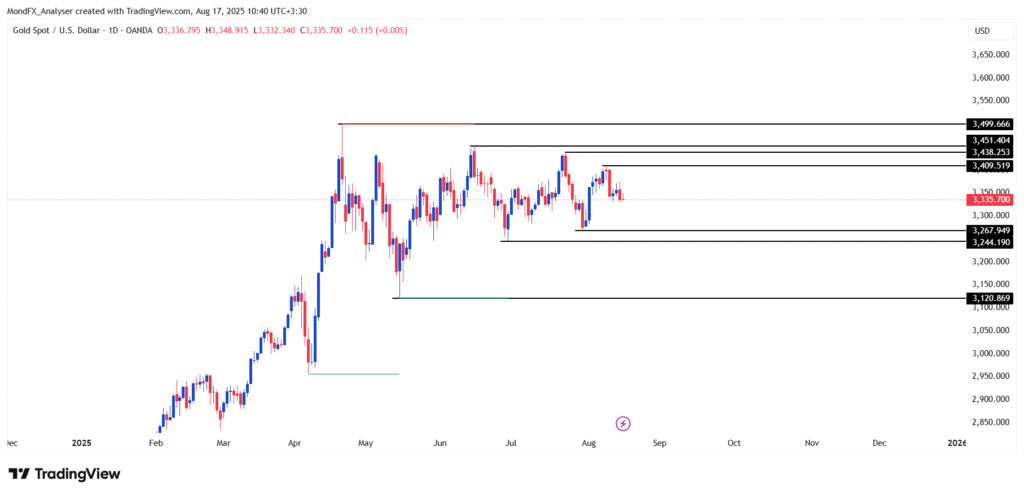

Global Gold Analysis (Daily Time Frame)

In the past week, the global gold ounce experienced a decline from the 3,400 USD zone on Monday and later consolidated near 3,300 USD on the lower timeframe towards the end of the week.

Main Scenario (with higher probability):

- The price can start a bullish move from the 3,267 USD support, continuing upward towards the 3,409 USD resistance.

- If the daily candle closes above the 3,409 USD resistance, the next target will be the 3,499 USD area.

- Trading volume and the positive reaction to support strengthen the scenario of a continued uptrend.

Alternative Scenario (with lower probability):

- If the price fails to break above 3,409 and returns below 3,267 with a bearish candle, the probability of a pullback towards the 3,244 USD support increases.

A break below the support levels would activate a deeper corrective scenario, making lower targets such as 3,244 USD and 3,120 USD more likely.

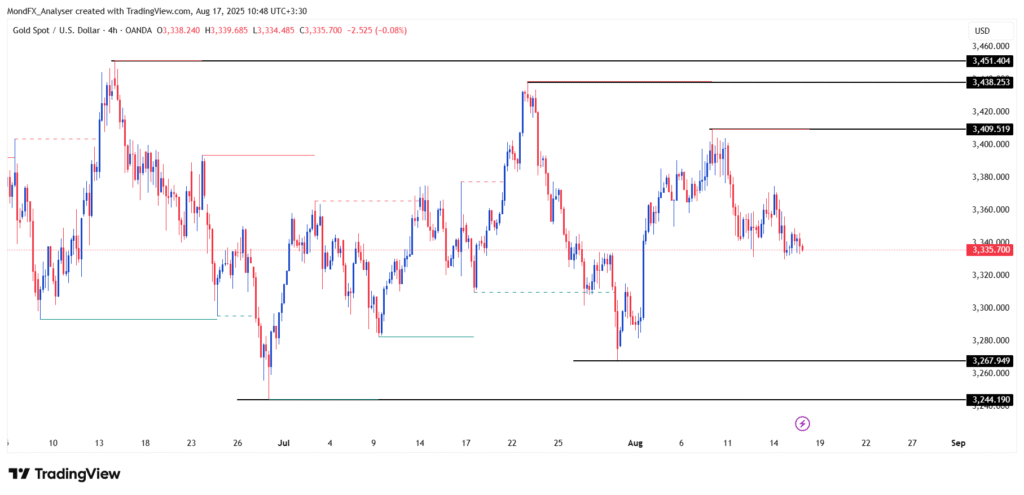

Gold Analysis (4-Hour Time Frame)

Main Scenario (with higher probability):

- If the price stabilizes above the 3,374 USD zone, it can rise towards the 3,409 USD area.

- If 4 hour candles close above the 3,409 USD resistance, the next target will be the 3,438 USD zone.

- Trading volume and the positive reaction to the support area strengthen the scenario of a continued uptrend.

Alternative Scenario (with lower probability):

- If the 3,374 USD resistance fails to break and the price is unable to overcome it, a pullback towards the 3,267 and even 3,244 USD supports is possible.

- A break in these supports would activate a deeper corrective scenario, making lower targets such as 3,204 USD more likely.

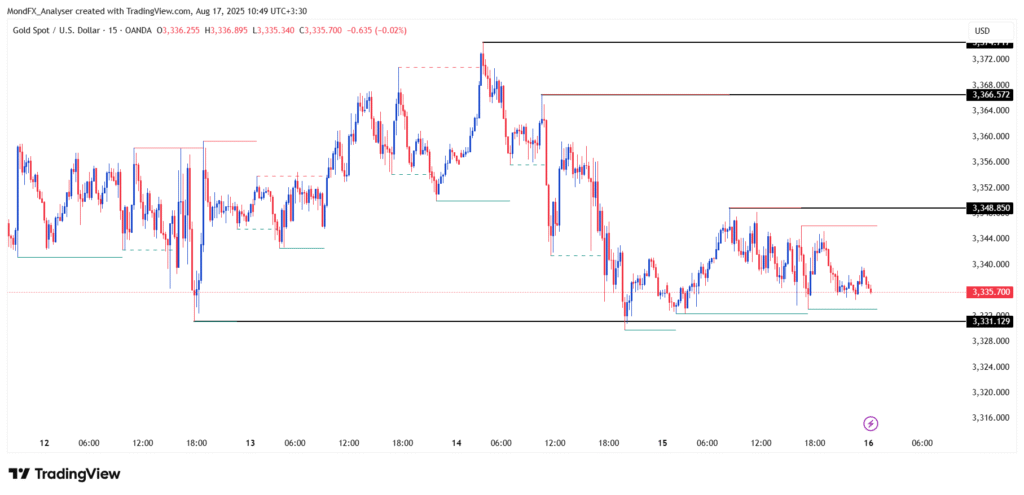

Gold Analysis (15-Minute Time Frame)

Main Scenario (with higher probability):

- The price has re-entered a ranging structure within the 3,333 – 3,346 USD zone and is now consolidating near the 3,333 USD area, making the probability of a decline towards the 3,329 USD support very high.

- If the 3,409 USD support breaks, the short term bearish wave could extend down to the previously broken 3,314 USD support.

- Stability below 3,329 USD along with selling pressure on the 15 minute timeframe confirms the bearish scenario.

Alternative Scenario (with lower probability):

- If the price fails to break below the 3,409 USD support, a short term bullish move towards the 3,348 USD zone becomes possible, and if that level is broken, the next target would be the 3,366 USD area.

- This scenario will only be activated if buying pressure intensifies and consecutive bullish candles form.