In the Forex market, Major Currency Pairs refer to currency pairs that account for the largest share of global trading volume and include the primary currencies of the world’s largest economies. These pairs are among the most popular choices for traders in the Forex market due to their high liquidity, reasonable volatility, and lower transaction costs.

Features of Major Currency Pairs

Major currency pairs possess several key characteristics that distinguish them from other types of currency pairs. One of the most important features is their high liquidity. Due to the large volume of transactions, liquidity in these pairs is extremely high, allowing traders to enter or exit the market with minimal delay at any given moment.

In addition, the spread on these pairs is typically lower because intense competition between brokers leads to reduced transaction costs. Another significant feature of major currency pairs is their predictability. Since these pairs are heavily influenced by economic news and key financial indicators, their price movements are generally more logical and easier to forecast compared to other currency pairs.

Moreover, the abundance of economic reports, market analyses, and educational resources available for these pairs makes it easier for traders to conduct accurate and informed analysis.

List of Major Currency Pairs

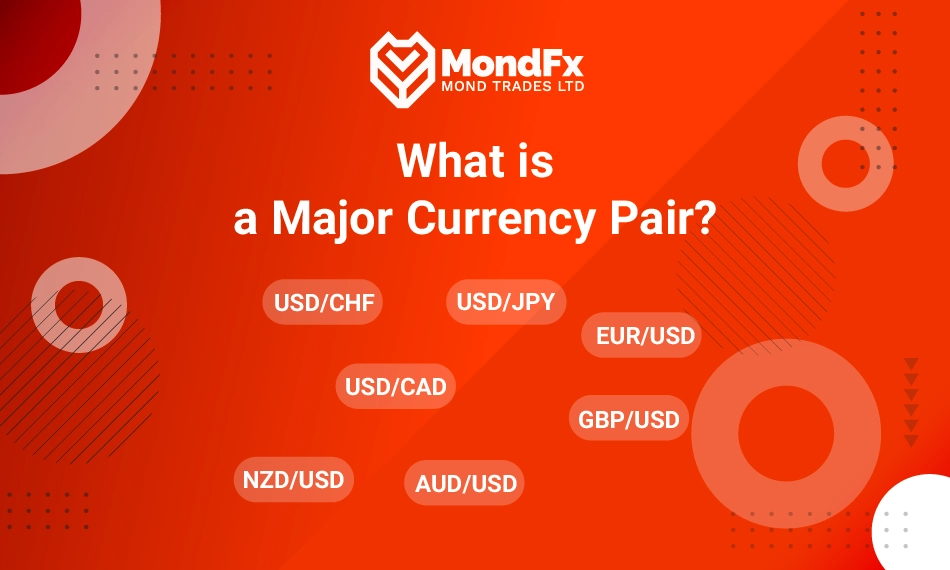

Major currency pairs include seven primary pairs that account for the largest trading volume in the Forex market. These pairs are as follows:

EUR/USD (Euro / US Dollar) — Known as the most popular currency pair in the Forex market, representing the world’s largest economies. Due to its high trading volume and moderate volatility, this pair consistently attracts traders’ attention.

USD/JPY (US Dollar / Japanese Yen) — Another significant pair that is highly popular due to the role of the Japanese yen as a safe haven currency during periods of economic uncertainty.

GBP/USD (British Pound / US Dollar) — This pair is notable for its high volatility and sensitivity to economic news from the UK, making it appealing to traders seeking profitable trading opportunities.

USD/CHF (US Dollar / Swiss Franc) — Due to the Swiss franc’s status as a safe haven currency, this pair tends to experience increased demand during times of economic uncertainty and financial crises.

AUD/USD (Australian Dollar / US Dollar) — This pair is significantly influenced by Australia’s heavy reliance on commodity exports and natural resources. Consequently, it is highly responsive to fluctuations in commodity prices, such as gold.

USD/CAD (US Dollar / Canadian Dollar) — As Canada’s economy is heavily dependent on oil exports, this pair is highly sensitive to changes in oil prices. Variations in oil prices often increase volatility in this pair.

NZD/USD (New Zealand Dollar / US Dollar) — The New Zealand economy’s dependence on agricultural and dairy exports makes this pair highly responsive to fluctuations in commodity prices, particularly agricultural products.

Major currency pairs are ideal for traders at all experience levels due to their characteristics such as high liquidity, reasonable volatility, and lower trading costs.

Why Do Traders Prefer Major Currency Pairs?

Traders in the Forex market typically prefer major currency pairs due to their lower costs and better trading conditions. Major currency pairs have lower spreads and commissions, resulting in reduced trading expenses compared to other pairs.

In addition, these pairs generally exhibit more stable and predictable price movements. Unlike exotic currency pairs, which often experience extreme and unpredictable price swings, major currency pairs tend to follow clearer and more analyzable price patterns.

Moreover, the availability of extensive educational resources, technical analysis, and fundamental insights for major currency pairs further enhances their appeal among Forex traders.

Important Tips for Trading Major Currency Pairs

To succeed in trading major currency pairs, it is essential to consider several key points. Following economic news is crucial, as major currency pairs are highly influenced by economic data such as employment reports, interest rates, and production indices.

Risk management is also of particular importance when trading these pairs. Despite their high liquidity and low spreads, sudden market fluctuations can lead to significant losses. Choosing the appropriate timeframe is equally important.

For major currency pairs, shorter timeframes (such as 15-minute or 1-hour charts) are suitable for day traders, while longer timeframes (such as daily or weekly charts) are better suited for long-term traders.

What is a Minor Currency Pair?

Minor Currency Pairs are currency pairs that do not include the US dollar (USD) but still consist of major global currencies. These pairs typically involve currencies from major economies such as the Euro (EUR), British Pound (GBP), Japanese Yen (JPY), Swiss Franc (CHF), Australian Dollar (AUD), Canadian Dollar (CAD), and New Zealand Dollar (NZD).

Compared to major currency pairs, minor pairs generally have lower liquidity, which may result in slightly higher spreads. Nevertheless, these pairs still offer considerable trading opportunities for experienced and professional traders.

Differences Between Major and Minor Currency Pairs

Major and minor currency pairs are both key groups in the Forex market, but they differ in structure, characteristics, and performance.

Presence of the US Dollar (USD):

The primary difference between major and minor currency pairs is the presence of the US dollar.

- Major pairs all include the USD as one of the two currencies in the pair. Examples include EUR/USD, USD/JPY, and GBP/USD.

- Minor pairs consist of major global currencies such as the Euro (EUR), British Pound (GBP), and Japanese Yen (JPY), but they do not include the USD. Examples include EUR/GBP and GBP/JPY.

Liquidity and Trading Volume:

Major currency pairs generally have higher liquidity as they account for the largest share of trading volume in the Forex market. High liquidity ensures faster and smoother trade execution.

Conversely, minor currency pairs have lower liquidity, which may cause slight delays in trade execution, especially during periods of low market activity or at the end of trading sessions.

Spread Levels:

Due to their higher trading volume, major currency pairs typically have lower spreads. Brokers generally charge lower fees for major pairs due to increased competition.

On the other hand, minor pairs tend to have higher spreads due to lower liquidity, potentially increasing trading costs for short-term traders.

Price Volatility:

Major currency pairs tend to have more stable and predictable price movements due to their high trading volume. As a result, these pairs are often favored by conservative traders and those following low-risk strategies.

Minor currency pairs, however, often experience sharper and more unpredictable price swings due to lower liquidity and greater sensitivity to local economic conditions. This volatility may create additional opportunities for risk-tolerant traders.

Influence of Economic News:

Major pairs are heavily influenced by US economic data, such as Non-Farm Payroll (NFP) reports, interest rate changes, and Federal Reserve decisions.

Minor pairs are more dependent on regional economic indicators. For example, EUR/GBP is particularly affected by economic developments in the Eurozone and the United Kingdom.

Suitability for Trading Strategies:

Major pairs are ideal for low-risk strategies and short-term trading methods like scalping and day trading due to their stability and low spreads.

Minor pairs, with their higher volatility and sudden price movements, are better suited for traders seeking higher-risk opportunities and larger potential profits.

Access to Analytical Resources:

Because major pairs are more popular, there is a wealth of analytical content, educational materials, and economic news available for these pairs. Conversely, information on minor pairs is more limited, requiring traders to conduct more extensive research.

Comparison Table of Major vs. Minor Currency Pairs

| Feature | Major Currency Pairs | Minor Currency Pairs |

| Presence of the USD | Includes the US dollar (USD) | Does not include the USD |

| Liquidity | Very high | Lower than major pairs |

| Spread | Lower | Higher |

| Price Volatility | Moderate and predictable | Higher and more unpredictable |

| Influence of Economic News | Influenced by US economic data | Influenced by regional economic data |

| Suitable Trading Strategies | Scalping and day trading | High-risk trades and larger profit potential |

| Availability of Resources | Extensive | Limited |

Major and minor currency pairs each have their unique characteristics, and choosing between them depends on your trading style and risk tolerance. If you seek a stable market with lower trading costs, major pairs are the ideal choice. On the other hand, if you are looking for opportunities with higher volatility and greater profit potential, minor pairs can be an attractive option.

Selecting the right pair according to your strategy can play a vital role in your success in the Forex market.

Why is EUR/USD the Most Profitable Currency Pair for Most Traders?

High Liquidity: EUR/USD has the highest trading volume in the Forex market. High liquidity means faster order execution, reduced slippage, and lower transaction costs.

Low Spread: Due to its popularity and high trading volume, the spread on EUR/USD is very low. This reduces transaction costs and increases profit margins.

Consistent Technical Behavior: EUR/USD generally follows clear technical patterns and responds well to technical and fundamental analysis, making it easier for traders to predict price movements.

Influence of Economic News: This currency pair is significantly influenced by key economic data such as Non-Farm Payroll (NFP) reports, European Central Bank (ECB) decisions, and Federal Reserve (Fed) policies. This creates numerous trading opportunities.

Moderate Volatility: Unlike highly volatile pairs such as GBP/JPY, EUR/USD has more stable price movements, making risk management easier.

Why is EUR/USD Suitable for Both Beginner and Professional Traders?

Due to its stable conditions, low spread, and high liquidity, EUR/USD is an ideal choice for beginner traders. At the same time, professional traders can also achieve consistent profits using advanced analysis strategies on this pair.

How to Choose a Currency Pair in Forex?

Selecting the right currency pair in Forex is one of the most important steps toward successful trading. To make an informed decision, traders should consider several factors to align their choice with their trading strategy. Below are the key criteria for choosing a currency pair in Forex:

1. Liquidity

High liquidity is one of the most important factors when selecting a currency pair. Pairs with higher liquidity usually have lower spreads, faster trade execution, and reduced trading costs.

Major pairs such as EUR/USD, GBP/USD, and USD/JPY are highly liquid and ideal for short-term and day trading strategies. Conversely, minor and exotic pairs have lower liquidity, which may result in delayed trade execution during low volatility periods.

2. Volatility

Volatility refers to the degree of price fluctuation within a given timeframe. Pairs with higher volatility create more profit opportunities but also involve higher risks.

If you seek fast and substantial profits, volatile pairs such as GBP/JPY or GBP/USD are suitable choices. On the other hand, pairs like EUR/USD and USD/JPY offer more stable price movements and are better for conservative traders.

3. Transaction Costs (Spread and Commission)

Transaction costs are a crucial factor in currency pair selection.

Major pairs typically have lower spreads due to their higher trading volume, reducing transaction costs and improving profitability. Conversely, minor and exotic pairs often have higher spreads due to lower liquidity, making them less suitable for short-term trades.

4. Impact of Economic News and Events

Some currency pairs are highly sensitive to economic news and monetary policy decisions.

For example, EUR/USD is significantly influenced by ECB and Fed announcements. Similarly, GBP/USD reacts strongly to UK economic data and Bank of England (BoE) decisions.

If your strategy relies on trading during news events, selecting pairs that are highly responsive to economic data can boost your trading success.

5. Market Session Timing

Each currency pair tends to experience peak trading volume and volatility during specific market sessions.

Pairs such as EUR/USD and GBP/USD are most active during the London-New York session overlap. Conversely, pairs like USD/JPY and AUD/JPY experience higher volatility during the Tokyo session. Choosing the right trading time can significantly impact your success.

6. Currency Pair Correlation

Understanding the correlation between currency pairs can help you avoid opening multiple trades with similar risk profiles.

For example, pairs such as EUR/USD and GBP/USD often move in the same direction, while pairs like USD/CHF and EUR/USD typically move in opposite directions. Recognizing these correlations allows you to manage your trades more effectively and reduce risk.

7. Trading Strategy

Your trading strategy significantly influences the best currency pair choice.

In scalping strategies, where quick trades are made within short timeframes, pairs with low spreads and high liquidity, such as EUR/USD and USD/JPY, are ideal.

For mid-term and long-term strategies, pairs influenced by strong economic trends, such as USD/CAD and AUD/USD, can provide better opportunities.

8. Trader Experience and Skill

A trader’s experience and knowledge play a key role in currency pair selection.

Beginner traders should start with pairs like EUR/USD, which have more predictable technical behavior. Conversely, experienced and risk-tolerant traders may prefer volatile pairs such as GBP/JPY and USD/CAD, which offer higher profit potential.

To choose the best currency pair in Forex, traders must consider factors such as liquidity, volatility, transaction costs, and economic news.

The EUR/USD pair, with its high liquidity, low spread, and stable technical behavior, is an excellent choice for both beginner and professional traders. Meanwhile, pairs like GBP/JPY or GBP/USD may appeal to traders seeking more volatile opportunities and higher potential profits.

Choosing the right pair that aligns with your strategy and risk tolerance is crucial for achieving long-term success in the Forex market.